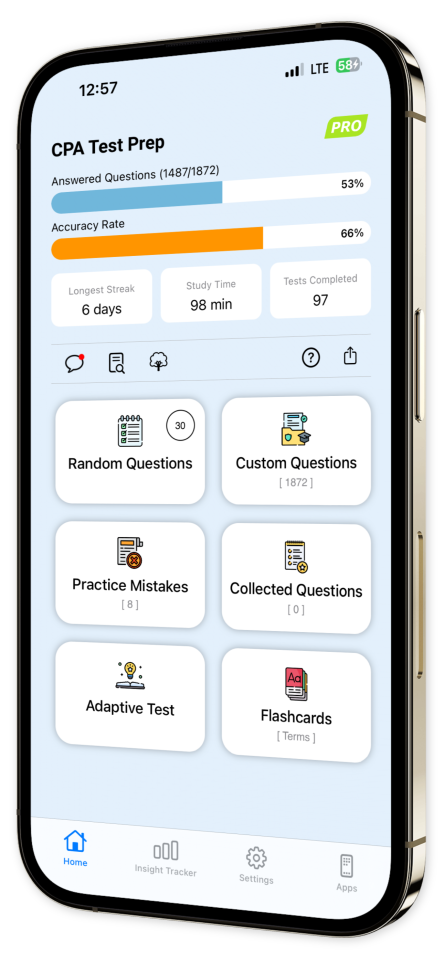

CPA Test Prep iOS and Android App

Excel in the CPA Exam with CPA Test Prep!

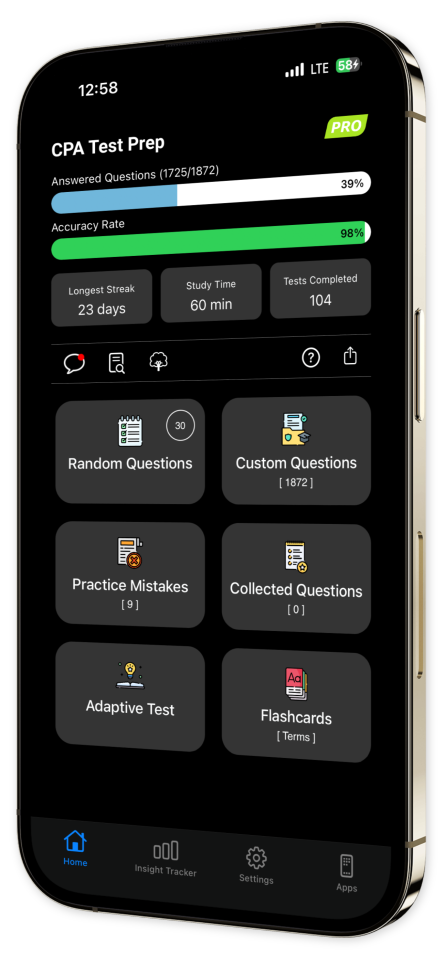

Ready to conquer the CPA exam and accelerate your accounting career? CPA Test Prep is crafted to make your study journey smarter and more efficient, equipping you with the expertise and tools to tackle every section of the exam with precision.

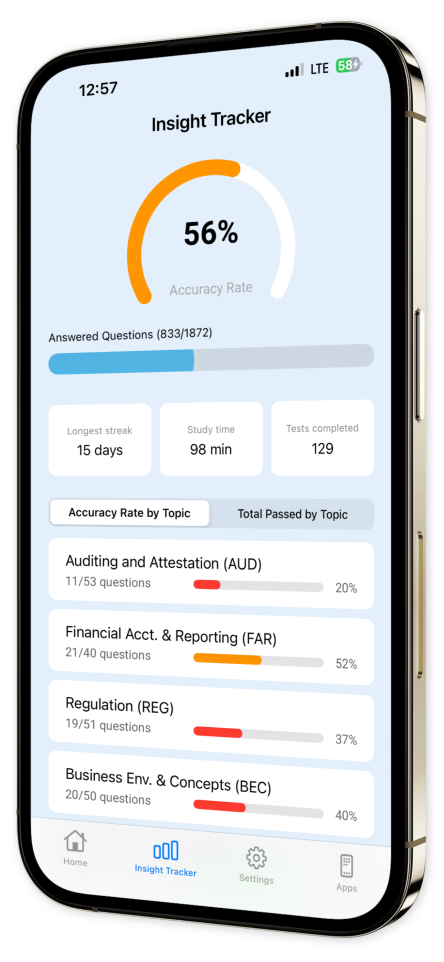

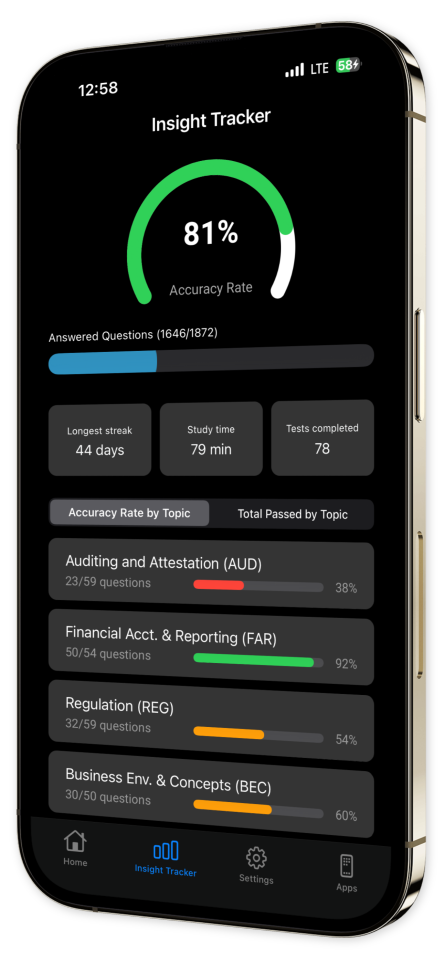

Our app offers expertly curated practice questions across all CPA sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). With in-depth explanations, you’ll not only learn the material but gain a comprehensive understanding of the underlying concepts, ensuring you're ready for real-world applications.

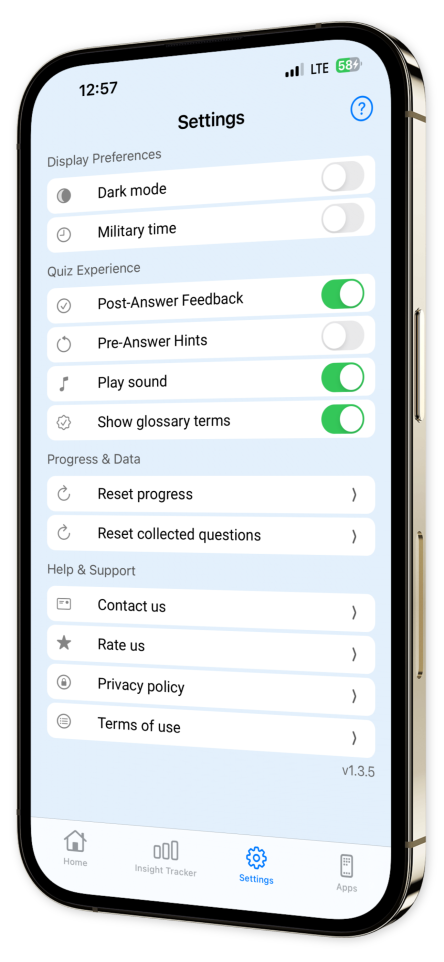

Customize your study sessions to suit your learning style. Track your progress, hone in on areas that need improvement, and sharpen your skills to ensure you’re fully prepared when exam day arrives.

Thousands of future CPAs trust CPA Test Prep to help them thrive on exam day. Take charge of your preparation and ensure you're poised for success!

Download now and begin your journey toward CPA certification with confidence and expertise!

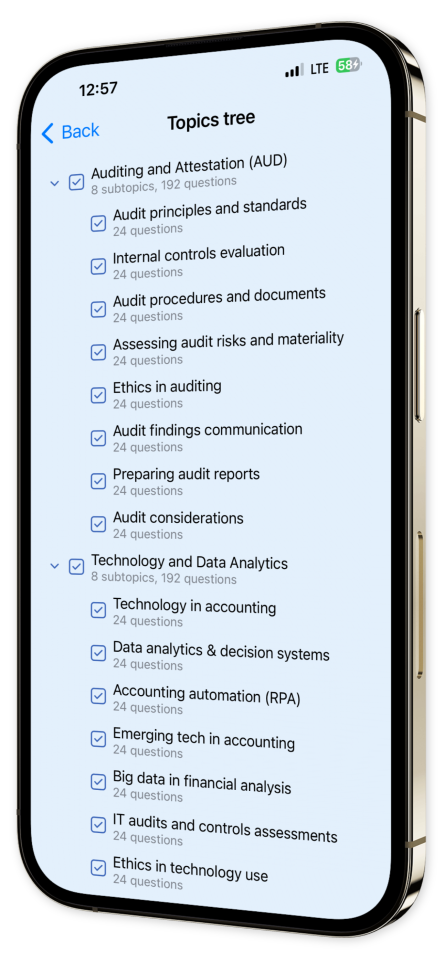

Content Overview

Explore a variety of topics covered in the app.

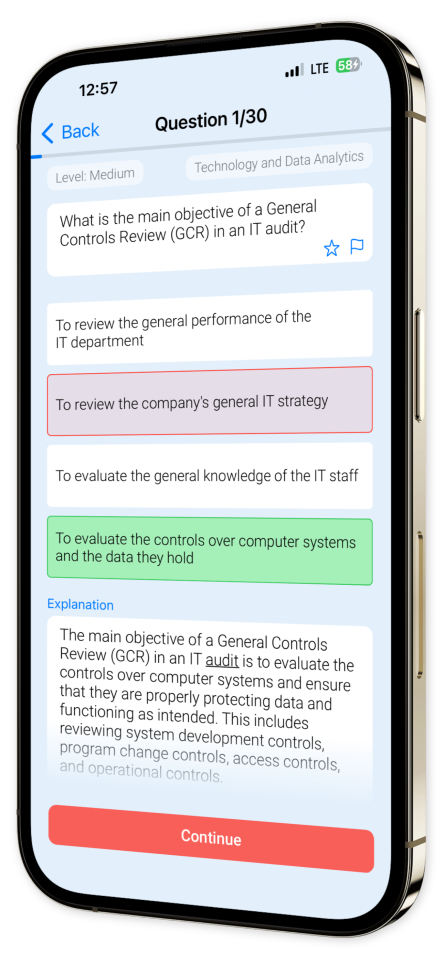

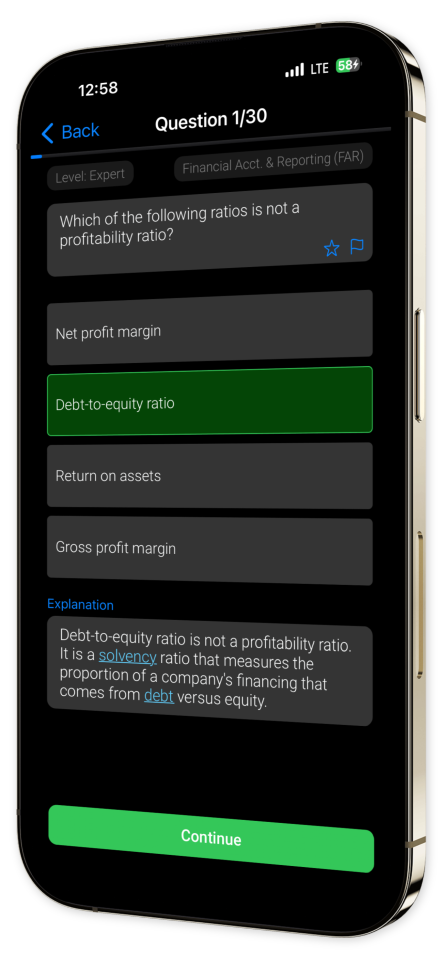

Example questions

Let's look at some sample questions

Which of the following is not an element of an unqualified audit opinion?

TitleAddresseeScope paragraphEmphasis of matter paragraph

An unqualified audit opinion typically includes a title, addressee, and a scope paragraph. An emphasis of matter paragraph is not a standard element of an unqualified audit opinion.

Which of the following is not a component of audit risk?

Inherent riskDetection riskControl riskFraud risk

Audit risk is composed of inherent risk, control risk, and detection risk. While fraud risk is a consideration in an audit, it is not a component of the audit risk model.

What is a derivative instrument?

A financial instrument that derives its value from the price of a physical assetA financial instrument that derives its value from the price of another financial instrumentA financial instrument that derives its value from the performance of an entityAll of the above

Derivative instruments derive their value from other variables such as the price of another financial instrument, the price of a physical asset, or the performance of an entity. Therefore, all options provided are correct.

How should a company report a correction of an error in previously issued financial statements?

As a prior period adjustmentIn the current period's income statementAs a change in accounting estimateNone of the above

A correction of an error in previously issued financial statements should be reported as a prior period adjustment, which involves restating the financial statements of prior periods to correct the error.

Which of the following entities are not subject to double taxation?

C CorporationS CorporationLimited Liability CompanyPartnership

S Corporations are not subject to double taxation. Income is passed through to the owners and reported on their personal tax returns.

Which entity type cannot have non-U.S. citizens as shareholders?

S CorporationLimited Liability CompanyPartnershipC Corporation

S Corporations cannot have non-U.S. citizens as shareholders. The other entities do not have this restriction.

What is Transfer Pricing in the context of international tax considerations?

The price at which divisions of a company transact with each otherThe price at which a company sells its assets to another companyThe price at which a company transfers its headquarters to another countryThe price at which a company buys a foreign company

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control.

Which of the following transactions would result in a taxable event for a limited liability company (LLC)?

Distribution of cash to membersDistribution of appreciated property to membersDistribution of depreciated property to membersNone of the above

In general, distributions of cash or property by an LLC to a member are not taxable events for the LLC. However, if the LLC distributes appreciated property, it must recognize a gain as if it had sold the property at its fair market value.

What is a unique aspect of auditing in the manufacturing sector?

Inventory valuationRevenue recognitionCost allocationAll of the above

Inventory valuation is a unique aspect of auditing in the manufacturing sector. This is because manufacturing companies typically have large amounts of inventory, which can be difficult to value accurately.

Which of the following is NOT a typical characteristic of a contract audit?

It focuses on the financial aspects of contractsIt ensures compliance with terms and conditions of contractsIt identifies areas of potential risk in contract managementIt determines the market value of the entity's stock

Contract audits focus on the financial aspects of contracts, ensuring compliance with their terms and conditions, and identifying areas of potential risk in contract management. They do not deal with determining the market value of the entity's stock.